|

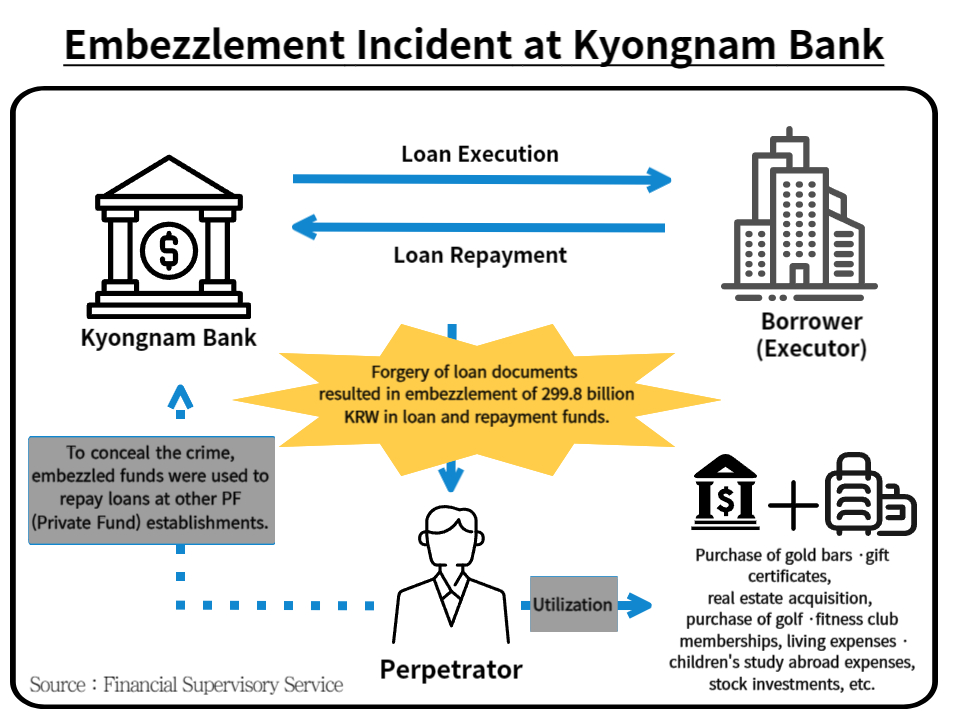

| ▲ Overview of the Kyongnam Bank Embezzlement Case |

On August 24th, the economic magazine 'Money Today' exclusively reported that an individual in charge of Kyongnam Bank's Project Financing (PF) embezzled 100 billion KRW. Kyongnam Bank estimated a net loss of 59.5 billion KRW due to the embezzlement incident. Following further investigation, the Financial Supervisory Service (FSS) revealed that the embezzled amount used to cover up the crime approached 300 billion KRW. The prosecution indicted Mr. Lee on charges of embezzling- 138.7 billion KRW, and during the first trial held on October 26th, Mr. Lee admitted to all of his charges.

How did such an incident occur? The FSS pointed to serious internal control deficiencies at BNK Financial Group, the holding company of Kyongnam Bank. Mr. Lee worked in the same department for a staggering 15 years as a person in charge of PF, a high- risk task. Furthermore, he handled both loan operations and post- loan management for PF. Abusing his position, Mr. Lee employed two primary methods in his criminal activities. Firstly, he embezzled loan funds through forged documents. By forging documents to execute loans, Mr. Lee transferred the disbursed funds a total of 13 times to accounts believed to be established by him and to those of his family and acquaintances. Secondly, he engaged in 'round- tripping' of loan repayment funds. Mr. Lee induced PF loan borrowers to deposit repayment amounts into accounts other than the legitimate ones specified in the loan agreements. If the borrower deposited into the correct account, he embezzled funds 64 times by forging fund execution request forms, using them for 'round- tripping' purposes. With the embezzled funds, he purchased gold bars and gift certificates, invested in real estate, bought golf and fitness club memberships, covered living expenses, children’s study abroad fees, and engaged in stock investments. Since the integration of Kyongnam Bank into BNK Financial Group in 2014, BNK Financial Group has not conducted audits on PF. In other words, the FSS's investigation revealed that Kyongnam Bank, where Mr. Lee worked in the same department for 15 years, had inadequate internal audits, including, “forced leave,” (a system in which employees performing tasks with a high risk of financial incidents are unexpectedly ordered to take leave by the company to prevent potential misconduct) and self- audit. Due to the deficiencies in internal audits, Kyongnam Bank failed to detect Mr. Lee's embezzlement for a long period of time.

Despite efforts in the financial sector to prevent misconduct, financial incidents, including embezzlement, are not uncommon. According to data from the FSS, losses incurred by the five major banks (KB Kookmin, Shinhan, Hana, Woori, and Nonghyup) from 2019 to September 2023 amounted to 113 billion KRW over five years. Among them, Woori Bank suffered the largest loss a year before the Kyongnam Bank incident, amounting to 76.4 billion KRW. The most significant issue is the remarkably low recovery rate of benefits from such financial crimes, standing at 12.5%.

This has led to increasing criticism directed towards the FSS for the need to establish a sound credit order and fair financial transaction practices within financial institutions. During the FSS's parliamentary audit on October 17th, strong criticism was directed at Director Lee Bok- hyun. In response, Lee acknowledged that the trust in financial companies might have been too high and promised a more rigorous oversight. The FSS is actively pursuing sanctions against embezzlement in the mutual financial sector. Additionally, discussions are underway to hold CEOs accountable for embezzlement incidents in major financial institutions.

The financial industry is like the heart of a capitalist society, supplying liquidity. Economic entities deposit money in banks, and as this money is invested, the financial system operates as a whole. Therefore, trust in the financial system is crucial. BNK Group has pledged a rigorous reform and innovation plan to prevent the recurrence of financial incidents and restore trust among shareholders and consumers. In July, financial authorities proposed measures for financial advancement and internationalization. To advance Korea's financial industry, it is essential to root out misconduct like this, and this process must inevitably go hand in hand with building fundamental trust in the financial sector.

By Kim Min-seong, reporter kms9494274@gmail.com

<저작권자 © The Campus Journal, 무단 전재 및 재배포 금지>

Shrinkflation, Consumer Deception

Shrinkflation, Consumer Deception