|

| ▲Front gate of the People's Bank of China (Source: Reuters)▲ 중국 인민은행 본점 정문 (Source : 로이터 통신) |

China's economy is showing concerning signs. According to China's customs statistics, the country's exports in July 2023 decreased by 14.5% compared to a year ago. This marks the largest decline since the initial outbreak of COVID- 19 in February 2020. Consumer inflation in China recorded its first year- on- year decrease since February 2021, as consumption slowed due to the pandemic. The real estate sector in China, which has been a driving force for the economy, continues to face challenges due to defaults by real estate companies such as 'Country Garden' and 'Sino- Ocean Group.' The youth unemployment rate is also rising, adding to the alarms sounding across various sectors of China's economy.

중국의 경제가 심상치 않다. 중국 세관 통계에 따르면 중국의 2023년 7월 수출액은 1년 전보다 14.5% 감소하였다. 이는 코로나 19가 처음 발생한 2020년 2월 이후 가장 큰 감소 폭이다. 중국의 소비자 물가는 코로나 팬데믹으로 인해 소비가 둔화하였던 2021년 2월 이후 처음으로 전년 대비 마이너스를 기록하였다. 중국 경제를 견인하던 부동산 경기 또한 '비구이위안', '위안양' 등 부동산 업체들의 채무불이행으로 악재만 지속되고 있다. 청년 실업률 또한 급증하는 등 많은 분야에서 중국 경제에 경종을 울리고 있다.

For the past 40 years, China's economic growth has been led by its real estate sector. China invested heavily in social infrastructure, particularly in transportation (roads, railways, aviation), ports, and energy, significantly increasing job creation and prosperity in related industries, like electronics and furniture manufacturing. As the Chinese acquired homes, their assets grew alongside the rapid economic expansion. This real estate and related industries sector came to constitute about a third of China's Gross Domestic Product (GDP), a phenomenon sometimes referred to as 'cement GDP,' as coined by Professor An Yuhua from Sungkyunkwan University's Graduate School of China Studies.

중국 경제성장의 40년 역사는 부동산 주도의 경제였다. 중국은 사회간접자본, 그중에서도 교통 (도로, 철로, 항공), 항구와 하운 시설, 에너지 분야를 중심으로 막대한 투자를 진행하였다. 이를 통해 중국 정부는 일자리를 제공하고, 관련 업종인 전자 및 가구산업들에도 호황이 찾아왔다. 집을 가진 중국인들은 중국의 초고속 경제성장과 함께 자산도 증대되었다. 이렇게 형성된 중국의 부동산 및 관련 산업이 차지하는 비중은 중국 국내총생산의 3분의 1로 비대해졌다. 성균관대학교 중국대학원의 안유화 교수는 이를 '시멘트 GDP'라고 칭하기도 하였다.

China's once rapid economic progress started to slow down in the face of the COVID- 19 pandemic. China, which pursued a robust "zero- COVID" policy during the pandemic, reported a much lower- than- expected economic growth rate of 0.4% in the second quarter of 2022. Many market participants initially predicted a strong rebound in China's economy after reopening. However, the housing market in China faced liquidity constraints due to tightened real estate investment regulations starting last year. As a result, many companies, including China's top real estate developer 'Evergrande,' declared defaults. This led to halted apartment construction and had negative effects on the broader economy, particularly impacting lower- income groups. Additionally, oversupply in the market led to soaring vacancy rates, contributing to an overall economic slowdown.

이렇게 고공행진 할 것 같던 중국의 경제는 코로나 팬데믹을 맞으며 둔화하기 시작했다. 코로나 팬데믹 시기 강력한 '제로 코로나' 정책을 추구했던 중국은 2022년 2분기, 시장의 전망치를 크게 밑돈 경제성장률 0.4%를 기록하였다. 많은 시장 참여자들은 중국의 경제가 리오프닝 (경제 활동 재개) 이후 크게 성장할 것이라고 예측했다. 하지만 중국의 주택 시장은 지난해부터 강화된 부동산 투자 규제 정책으로 인해 유동성이 제한되는 상황을 겪게 되었다. 이에 따라, 중국 부동산 1위 개발업체 '헝다'를 비롯해 많은 업체가 채무불이행을 선언했다. 이에 따라 아파트 공사 중단이 발생하였고, 이는 곧 서민 경제에 악영향으로 작용했다. 또한 공급 과잉으로 인해 공실률이 치솟는 등 경제 침체 분위기가 이어지고 있다.

Some analysts attribute the recent economic slowdown in China to the limitations of its economic system, often referred to as "socialism with Chinese characteristics." Professor Hyun Sang- baek and four others pointed out in a KIEP (Korean Institute for International Economic Policy) policy briefing that, "While China provided a timetable for opening up after joining the WTO (World Trade Organization), the opening of the financial sector has been progressing slowly compared to other areas such as manufacturing." Unlike Western advanced economies that rely more on equity markets for funding, Chinese companies heavily depend on bank loans. According to 'One Road Research,' a private think tank, only about 5% of Chinese companies' funding comes from the stock market. As a result, a substantial portion of Chinese banks' loan portfolios are tied to real estate, creating a situation where risks in the real estate market ripple across other economic sectors.

이번 발생한 일련의 중국 경기의 침체는 중국의 경제체제인 '사회주의 시장 경제'의 한계라는 분석도 존재한다. 현상백 교수 외 4명은 KIEP 정책연구 브리핑을 통해 “WTO 가입 이후 중국은 개방 시간표도 제시하였지만, 제조업 등 다른 분야와 달리 금융 분야의 개방은 더디게 진행되고 있다”라고 지적했다. 자금의 원천을 주식 시장에서 공급받는 서방 선진국들과는 다르게, 중국 기업의 자금 원천은 은행 대출에 크게 의존하는 편이다. 민간 싱크탱크인 'One Road Research'의 ‘PBOC Financial Stability Report’에 따르면 중국 기업의 자금조달 방식 중 주식 자금은 약 5%에 불과하단 걸 알 수 있다. 이러한 이유로 중국 은행들의 대출 포트폴리오 상당 부분이 부동산 관련 대출로 묶여 있으며, 현재 부동산 시장의 리스크가 다른 경제 부문에 파급 효과를 미치고 있다 해석할 수 있다.

To address these liquidity concerns, the People's Bank of China lowered the one- year loan interest rate from 3.55% to 3.45%. Additionally, the National Development and Reform Commission of China announced "20 measures for consumption recovery and expansion" last month. However, the market has responded skeptically to China's measures so far, as they are seen as not providing direct fiscal stimulus.

이러한 유동성 우려에 대응해 중국 인민은행은 1년 만기 대출 금리를 3.55%에서 3.45%로 인하하는 등 급한 불 끄기에 나섰다. 더불어 중국 국가발전개혁위원회는 지난달 31일 ‘소비 회복 및 확대에 관한 20개 조치’를 발표했다. 하지만 시장은 직접적인 재정 부양책이 아니라는 이유로 중국의 지금까지의 대응책에 냉담하게 반응하고 있다.

The South Korean government and businesses, which heavily rely on China for exports, are also acutely sensitive to the risks posed by China's economic situation. Prime Minister Han Duck- soo stated during a government inquiry in June 2022, "China's economy is heading towards a near collapse," emphasizing the need to prepare countermeasures. The Ministry of Economy and Finance has established a "China Economic Situation Team" to proactively monitor and respond to the growing uncertainties.

대중국 수출 의존도가 높은 한국 정부와 기업 또한 중국 리스크에 대해 예민하게 반응하고 있다. 한덕수 국무총리는 2022년 6월 대정부질문에서 “중국 경제가 거의 꼬라박는 수준으로 가고 있다”라며 이에 대비책을 마련해야 한다고 주장했다. 현재 기획재정부는 커지는 불확실성에 대비해 중국 리스크에 선제적으로 대응할 수 있도록 ‘중국경제 상황반’을 신설하여 집중 모니터링 하고 있다.

While experts believe that the current downturn is unlikely to escalate into an international financial crisis akin to the 2008 Lehman Brothers event, the effects of China's economic slowdown, given the ongoing reshoring and efforts to diversify supply chains, are of global concern. With China's role as the world's factory diminishing, the impact of its economic downturn on the global economy is a topic of great interest. Furthermore, the focus is now on the potential future shifts in China's previously guarded financial market following this economic slowdown.

서방 전문가들은 이번의 침체가 2008년 리먼 브러더스 사태와 같은 국제적 금융위기로 번질 가능성은 적다고 진단하고 있다. 하지만 각국의 리쇼어링이 가속하며 별도의 공급망을 갖추려고 노력하고 있는 상황에서, 세계 공장을 담당했던 중국의 경기 침체가 세계 경제에 어떻게 작용할 지 주목할 필요가 있다. 한편, 이번 침체를 기점으로 그동안 개방을 꺼려왔던 중국 금융 시장의 향후 변동 가능성에도 이목이 집중되고 있다.

- decline : 감소

- vacancy rate : 공실률

- constraint : 제약, 제한

- countermeasure : 대응책

By Kim Min-seong, reporter kms9494274@gmail.com

<저작권자 © The Campus Journal, 무단 전재 및 재배포 금지>

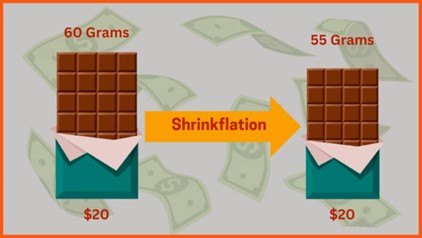

Shrinkflation, Consumer Deception

Shrinkflation, Consumer Deception