|

|

▲ Closed gate of Silicon Valley Bank due to bankruptcy (Source : UPI) |

The whole world was shocked as the Silicon Valley Bank (SVB) entered the bankruptcy process. SVB was a bank established in 1983, specializing in new technology companies, and has played a major role in investing in startups and venture capital of the Silicon Valley, Northern California, in the United States. SVB, which was the 16th largest bank in the U.S., was an important cash cow, having 44% of U.S. tech and healthcare ventures as customers. SVB’s bankruptcy is the largest since the Washington Mutual, which collapsed during the 2008 financial crisis, making it the second- largest bank bankruptcy in U.S. history. As a result, public attention and concerns are being focused on how the bankruptcy of SVB will affect both the global and the domestic economy.

According to the financial sector and foreign media, SVB went bankrupt because of bank- runs caused by interest rate hikes, which led to deterioration of its financial structure. SVB invested a large number of U.S. treasury bonds during the pandemic, and as the Federal Government had raised its base rate last year, SVB lost a lot due to the fallen value of U.S. treasury bonds. At the same time, the IPO (Initial Public Offering) market was postponed or withdrawn, and startups, the main customers of SVB, began to withdraw deposits. As a result, SVB had to sell long- term U.S. treasury bonds and lost about $1.8 billion (about 2.38 trillion won). With the announcement, SVB’s stock price plunged more than 60%, which accelerated the withdrawal of deposits by anxious customers. The California Financial Regulator closed the bank on the 10th, citing insufficient liquidity and insolvency of SVB, and appointed the Federal Deposit Insurance Corporation (FDIC) as receiver.

Local experts predict that the high- speed bankruptcy of SVB will not spread to a crisis of the entire financial industry. This is because SVB’s customers are concentrated in the US technology industry, so the transition of the crisis is limited. This is due in part to the U.S. government for responding quickly to the situation. On the 12th, the U.S. Administration announced that they will guarantee the full amount of money deposited by SVB’s customers regardless of the insurance limit. This is due to the observation that if depositors aren’t protected, large- scale unemployment in the startup industry will be inevitable. The FDIC has also quickly launched an auction process for bank assets to return as many deposits as possible before startups suffer financial difficulties.

The U.S. Justice Department and the Securities and Exchange Commission (SEC) also started independent investigations into the bankruptcy of SVB, helping to identify and suppress the situation. The authorities' investigation includes the controversy over the sale of shares by Silicon Valley Financial executives, the parent company of SVB, before bankruptcy. The group's chairman sold shares last month and netted about $3.6 billion, and the chief financial officer was found to have sold $575,180 in stocks the same day. Gary Gensler, Chairman of the Securities and Exchange Commission (SEC), suggested the possibility of an investigation into not only SVB but also for various regional banks where risks arose. “Without speaking to any individual entity or person, we will investigate and bring enforcement actions if we find violations of the federal securities laws,” Gensler said, expressing his willingness to eradicate violations of the Federal Securities Act.

The Korean government is also closely monitoring the aftermath of the bankruptcy of SVB. "Although the impact is still widely expected to be limited and will not spread to global financial and economic risks, we will further strengthen real- time monitoring to minimize negative impacts on the Korean financial market and the real economy as uncertainties over the future fallout are high," Deputy Prime Minister and Minister of Economy and Finance, Choo Kyung- ho said in a meeting at Sejong Government Complex. The government needs to take appropriate measures to prevent the anxiety of the financial crisis caused by bankruptcy from spreading into the domestic financial market.

By Kim So-ha, cub-reporter lucky.river16@gmail.com

<저작권자 © The Campus Journal, 무단 전재 및 재배포 금지>

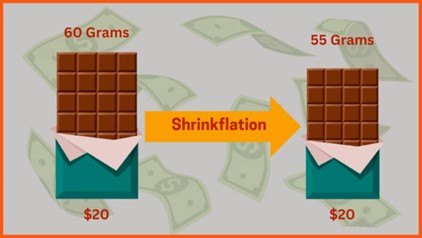

Shrinkflation, Consumer Deception

Shrinkflation, Consumer Deception