|

Credit Transactions

People usually think about financial issues in terms of banks, but there are three parts of finance; the banking sector, the non-banking sector and the third finance. The banking sector means commercial banks which we can easily access such as Kookmin Bank (KB), Shinhan Bank, Woori Bank, Busan Bank, and so on. They are financial institutions that attract deposits or offer loans to people. The non-banking sector, like card companies, credit institutions with comprehensive services, and investment trust companies, provide financial support and services or perform financing opportunities for the poor. Third party financing includes credit loans, private loans and consumer financing. If you understand these concepts first, it will be easier to comprehend other information about credit transactions.

Getting line of credit can be good. When you open this "bankbook" account, the balance on your account is 0. However you can withdraw! For example, if you withdraw 100,000 won, the balance shows -100,000 won, and if you pay 100,000won, the balance shows 0 again. Remember that you have to pay interest on the amount of money which is marked as minus (-). Also you should be careful to meet the expiration date of your credit line. Large dept might be incurred when the due date arrives after one year. You must not forget that this is all based on a loan, even though its name is "bankbook."

|

There are many university students who cook their own meals. In the case that a boiler breaks down, who should repair it? In Korea, people think a house owner must fix all parts of the house. However, the problem is not simple. A contract concerning the conditions of a leased house is very important. If you do not check the conditions closely, you may have the blame shifted on to yourself because a tenant has a duty to cover certain costs. You have to read carefully and to check the contract several times.

What are you going to do when the owner of the house suddenly gives you notice to raise your security deposit. You do not have to pay it. The period of a lease is commonly two years. The tenants are protected by the Housing Lease Protection Act. According to this law, if the house owner does not say anything from six months to one month before the expiration date, it means that they agree to extend the lease under the same condition. Although the landlord can demand raising the security deposit, only 5% of the current deposit is allowed. However, the problem is when the owner demands raising the deposit during the time of the termination of an agreement. Then you had better see whether it is a condition of the contract. You must learn to examine every contract condition well in the future.

|

Interest rates

Interest rates may be defined in many ways, but a simple and direct definition is the amount of interest that must be paid. It is expressed as a percentage of the amount that is borrowed or gained as profit. Sometimes we need money to do something or put our money in bank. In those cases, we take or give interest, which is the price given in return for the principal’s benefit. The interest rate is a percentage of the principal amount loaned or borrowed.

The interest on a loan is important when individuals or businesses borrow money from banks. If the interest is rising, their burdens of interest will increase. That would severely put pressure on the national economy because individuals spend less and businesses cut back on investments for research, development and new businesses. So the government adjusts interest rates optimally to boost domestic demand, consumer spending and corporate activities.

The interest on a loan is directly linked with expenditure, however, deposit interest rates are directly linked with revenue. If the interest is climbing, individuals’ and businesses’ profits of interest are increasing. That would have positive effects on economy because they put more money in banks than before. Deposits are the source of various capital requirements to development an economy.

Interest rates are divided into simple and compound interest, according to their method of calculation. Simple interest is interest that is calculated on an original sum of money but not also on the interest which has been added to the sum; however, compound interest is interest that is calculated both on an original sum of money and on interest which has previously been added to the sum. So we can receive more interest with a compound interest rate than with simple interest.

And interest rates are also divided into nominal and effective interest rates. Nominal rates do not consider the fluctuating value of money; however, the effective rate does consider it.

Interest rates are determined by supply and demand of capital in the financial market. So interest rates increase when the demand for capital is greater than the supply of it. On the other hand, interest rates come down when the supply of capital is more than the demand for it.

Prices

We often hear news about rising or falling prices. Price is defined as the amount of money that we have to pay in order to buy something, or the level of various products' and services' values.

The most common price indexes are the Consumer and Producer Price Indexes. The Consumer Price Index (CPI) expresses the fluctuation of living expenses as time passes. In detail, CPI is defined as the average cost to purchase products or services.

And Producer Price Index (PPI) expresses the fluctuation of all products’ or some services’ price in the primary market of transaction among businesses. Effectively, CPI and PPI influence our lives in detail. If prices are increasing, consumers must pay more money than before to purchase any products or services.

Price index is expressed as a variance of price between a base point and a comparison point of the average value of various products and services. In Korea, the Bank of Korea makes and announces price indexes annually.

One reason prices increase is the advance of raw materials. The advance causes depreciation, so property values rise. Another reason is excess demand. When demand exceeds supply of a specific product, the product’s price increases due to some consumers being willing to pay even more for the rare item.

Jo Young-in, Kim Dae-gon youngwon13@naver.com

<저작권자 © The Campus Journal, 무단 전재 및 재배포 금지>

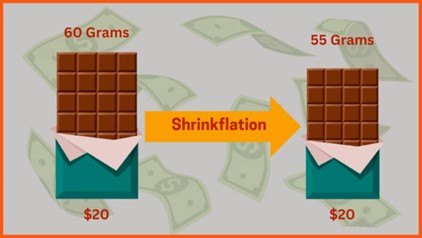

Shrinkflation, Consumer Deception

Shrinkflation, Consumer Deception