The won-dollar exchange rate reached and then later exceeded 1,400 won on September 22nd of this year. It has been 13 years and 6 months since the won-dollar exchange rate topped 1,400 won, a phenomenon last seen in March 2009, during the Global Financial Crisis. For South Korea, a country with high external dependence on other countries, this rising exchange rate could spell a disaster in the making.

There are two main reasons for the current strength of the US dollar, otherwise colloquially known as the “king dollar” phenomenon. First and foremost, the CPI rate (Consumer Price Index) around the world has risen rapidly due to the global money supply proliferating, which occurred during the Covid-19 pandemic. In Germany, the CPI rate reached 7.9%, the highest rate since 1973. In the United States, the CPI rate marked 9.1% as of June 2022, the highest rate in 41 years since 1981 when there was another major factor at play: an oil shock.

Jerome Powell, the Chairman of the Federal Reserve Board (FED) in the United States, said, “inflation is transitory,” in April 2021, expressing a need to wait for interest rates to rise in counterbalance to inflation. However, back in December 2021, after the CPI had risen more than 5% for 6 consecutive months, he made a follow-up statement where he explained they, “took a step back from ‘transitory’ [thinking],” admitting his mistaken outlook on the state of inflation in the US. He implied that the FED will soon start on their Tightening Monetary Policy. Following this trend set by the FED, the Federal Open Market Committee (FOMC) thrusted their CPI goal down to 2% and raised the base interest by 0.75% (Giant Step) three times, causing the base interest rate in the United States to rise to 3.25%. Then, because of the reversal of the base interest rate and the South Korean base interest rate being 2.5%, investors began to move their assets into US dollars, because it is a key currency, and a safe way to keep their assets secured.

The second reason for the “king dollar” phenomenon can be attributed to other external factors, which are not necessarily related to basic economic principles, such as inflation cycles. Other external factors affecting the strength of the US dollar are things such as the global supply chain crisis and the recession following Covid-19, the Russian-Ukrainian war, and Saudi Crown Prince Mohammed Bin Salman’s conflicts with the Western world, which caused oil and natural gas prices to rise rapidly. Additionally, there was some anticipation of a recession in the Chinese economy due to the country’s ‘Zero-Covid Policy,’ as well as the US-China trade war. China is a very significant trade partner for South Korea, therefore, uncertainty surrounding the state of the Chinese economy caused a consequential and considerable degradation in the value of the Korean won. This can be explained in simple terms as being due to investors wanting to put their money into safer currencies, with low risk, one of which being the US dollar. This causes the strength of the US dollar to climb even higher, as people move their assets, furthering the divide between currencies.

This current trend, of a strong US dollar and inflation, is more than likely to be continuous. The main concern surrounding this is that the United States’ FED only has two more opportunities to raise the base interest rate to combat inflation during their last two meetings of this year, all while worrying about tapering it nationally. After the Federal Open Market Committee (FOMC) meeting on September 21st, the Federal Reserve Board announced the outlook of the base interest rate, in the United States according to a dot plot, was up to 4.4% for the end of this year. Due to the reversal of the base interest rate, which already happened in Korea, if the Bank of Korea (BOK) proceeds according to previous plans and continues to raise the base interest rate by 0.25% (otherwise known as “Baby Step”), there are some predictions that the reversal of the base interest rate will climb up to 1.5%. That begs the question: “What will happen to Korea if the ‘king dollar’ phenomenon doesn’t stop?”

Lee Chang Yong, the Chairman of the BOK, recounted to reporters in MyeongDong on September 22nd that the precondition of raising the base interest rate by 0.25% has been changed, implying a plan for an increased raise of 0.5% (“Big Step”). According to the BOK, the whole sum of household debt in Korea is 1 quadrillion, 869 trillion, 400 billion KRW as of the 2nd quarter of 2022. South Korea’s accumulated trade deficit is 29 billion, 224 million USD according to a report by the Korea Customs Service, the highest recorded trade deficit in history since 1996, when it was 20 billion, 624 million USD. These numbers arguably forecast that the financial burden on the Korean people will become even more cumbersome

A high exchange rate could act as a beneficial influence for companies that export finished goods outside of Korea, however, it could alternatively be a nightmare for companies that actually manufacture the products, by buying and importing expensive raw materials from overseas. Concerns surrounding the high and ever-climbing won-dollar exchange rate along with a rise in the price of raw materials, could be a large contributing factor to aggravating the already large trade deficit.

|

| The won-dollar conversion rate since 1981 (Source: Investing.com) |

Kim Min Seong, cub-reporter kms9494274@gmail.com

<저작권자 © The Campus Journal, 무단 전재 및 재배포 금지>

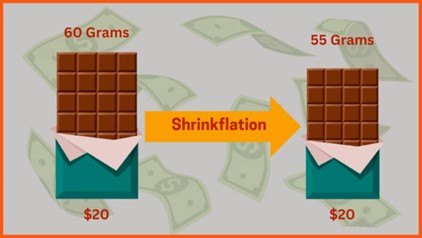

Shrinkflation, Consumer Deception

Shrinkflation, Consumer Deception