|

| ▲ Dealers are working in the dealing room of Hana Bank's headquarters in Jung- gu, Seoul, on April 26, when they were confused by stock price manipulation from SG Securities (Source: Yonhap News) |

According to the Korea Exchange on April 26, the market capitalization of eight stocks, including Sunkwang, Harim Holdings, Sebang, Samcheon- ri, Daesung Holdings, Seoul Gas, Daol Investment & Securities, and Dow Data, fell by KRW 4.1995 trillion. In the case of Daesung Holdings, Samcheon- ri, and Seoul Gas, the market capitalization of more than 1 trillion won evaporated, while Dow Data and Harim Holdings fell by 850 billion won and 710 billion won, respectively. On April 24, eight stocks were suddenly sold in large quantities by the foreign brokerage SG Securities, which led to a price limit on the volume of falling sales. R&K Investment Advisory CEO Ra Deok- yeon, who is currently known as a stock price manipulator of SG Securities, is under growing controversy over his excessive Debt Investment. In response, CEO Ra countered, "We only invested in undervalued stocks without market manipulation." However, the reality is that it is necessary to boost stock prices by attracting investor debt.

Meanwhile, the authorities said, "We confirmed the situation in which stock price manipulation forces raised stock prices through a Notification Transaction, in which buyers and sellers set prices to raise stock prices and then sold them urgently." The main cause of the stock price plunge from SG Securities was CFD (Contract for Difference). CFD, which is used as a Stock Price Manipulation Channel for stock price manipulation forces, can enjoy leverage effects and tax benefits, even without stocks. Stock price manipulation forces guaranteed anonymity through CFD accounts. CFD orders are executed by securities firms, not investors.

The joint investigation team of the Seoul Southern District Prosecutors' Office and the Financial Services Commission, which are investigating the plunge in stock prices from SG Securities, raided the office of R Investment Adviser Ra Deok- yeon, who is suspected of being the chief stock manipulator. The Signiel office, which was raided by the investigation team, is a separate place from the office of R Investment Advisory Company in Gangnam-gu, Seoul, which was raided on April 27. Signiel's office, known to have monthly rent of tens of millions of won, was used by Ahn and Byun to recruit a large number of investors. In addition, the investigation team included Son's residence, which is suspected place where CEO Ra helped siphon fees received from investors, in the search and seizure. The investigation team is also searching for an indoor golf practice range in Gangnam- gu, Seoul, which was used to recruit investors, and a restaurant in Gwangjin- gu, Seoul, where suspicions arose after receiving investment fees in the form of, "Card Gang." The investigation team stated in the search and seizure warrant that Mr. Ra's group violated the prohibition of unregistered business activities and prohibition of market price manipulation under the Capital Markets Act.

In addition, it was revealed that the victims' credit cards were handed over, paid fees on behalf of them, and misappropriated profits, which was found to have violated the Criminal Proceeds Concealment Regulation Act. Investors who suffered financial damage due to the plunge in SG Securities stock price manipulation judged that Ra's group had intended to deceive them from the beginning and make property gains. In response, investors said, "We will sue a group of stock price manipulators for fraud and occupational breach of trust under the Specific Economic Crimes Act." According to one victim, "Stock price manipulation forces used CFD accounts in the victim's name to leverage or generate unpaid debts in general stock accounts," he said. "In the process, each security company did not properly implement wire confirmation procedures and risk notices, and we are pushing ahead with ruthless collection."

Many people seem to have suffered financial loss due to the recent plunge in SG Securities stock price manipulation. Regarding this situation, Lee Bok- hyun, head of the Financial Supervisory Service, said at an executive meeting on April 25, "There is a concern that the risk of losses due to excessive leverage investments may increase."

By Park ChaeHyun, cub-reporter parkch2582@naver.com

<저작권자 © The Campus Journal, 무단 전재 및 재배포 금지>

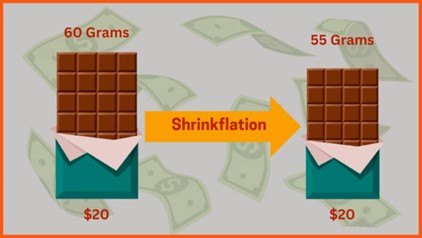

Shrinkflation, Consumer Deception

Shrinkflation, Consumer Deception