Hanjin KAL, will takeover Asiana Airlines as Asiana’s state-run creditor Korea Development Bank (KDB) plans to inject funds into Hanjin KAL (the parent company of Korean Airlines and holding company of Hanjin Group). Since its establishment in 1988, Asiana Airlines has maintained its number two position in the Korean aviation industry. However, Asiana Airlines has long been plagued by mounting debts and financial difficulties and is currently dealing with the rapidly worsening aviation industry due to the COVID-19 pandemic.

Many concerns arose in the process of the takeover. First, the KDB will invest a huge amount of funds in Hanjin KAL and become a major shareholder of Hanjin KAL. This will stabilize the control of the family that owns Hanjin KAL, which is facing a management dispute, raising the issue of preferential access for Chaebol. In addition, KDB could lead to airline dominance through Hanjin KAL, so the logic of government or politics, not market logic, can be reflected in airline management.

Secondly, the low cost airline subsidiaries of Korean Air and Asiana Airlines account for more than 60 percent of the air passenger market. This leads to a monopoly. There are concerns that the collapse of the competition system will limit consumers' options, which will increase air fares and worsen services.

Third, some labor unions from both companies oppose the merger, saying they are concerned about job insecurity. Cho Won-tae, chairman of the family that owns Hanjin KAL, said they would not be restructuring at this time, but large-scale restructuring will be inevitable because of the many overlapping routes and similar work.

Kim Da-eun, a student in the Department of English Language & Literature at Changwon National University, expressed her opinion on the takeover, saying, "It is regrettable that there is only one large airline left in the Korean aviation industry after Korean Air took over Asiana Airlines. I hope that the merger and acquisition will be successful and Korean Air will be able to compete with major airlines around the world".

The KDB announced its plan to reform the aviation industry by following the three major principles of restructuring: responsible shareholders, sharing loss among stakeholders, and preparing sustainable normalization measures. Korean Air and the KDB should have management that is transparent, that conducts business aboveboard, and that strives to secure competitiveness in the aviation industry.

By Seo Hyo-bin cub-reporter tjdowls99@naver.com

<저작권자 © The Campus Journal, 무단 전재 및 재배포 금지>

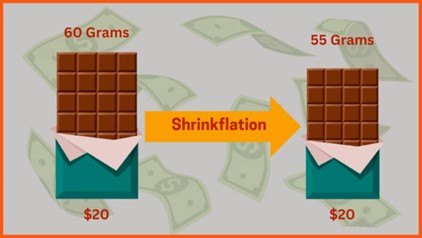

Shrinkflation, Consumer Deception

Shrinkflation, Consumer Deception