|

| ▲Direct purchases on overseas sites |

Recently, many people have been shopping on overseas websites. Direct purchases can be purchased at a lower price than domestic purchases. Some people buy items from overseas online sites and sell them back to used trading sites. This is because either the delivery period is too long or they don't like the product when they check it. However, if goods purchased overseas are sold again in Korea, it is smuggling. According to the Korea Customs Service, 279 people sold goods bought overseas in the first half of this year. They sold mainly shoes and clothes, three to four times more expensive than the purchase price, therefore, they made a significant profit. There is also a case in which goods purchased from overseas websites were posted on used trading sites, which received a warning by the Korea Customs Service.

Tariffs and surtaxes are imposed not only on overseas websites, but also on all goods entering Korea from abroad, to protect the domestic economy. The Tariff Law stipulates that goods purchased directly from overseas, must be less than $150 US Dollars to be exempt from taxes for only personal use. If the standard amount is exceeded, tariffs and surtaxes must be paid on the total amount. Therefore, even if goods purchased for personal use are exempt from taxation, if the consumer sells their goods, they may be punished for violating the Customs Law or for Tax Evasion. Goods that have already paid taxes are not in violation of the Customs Law. However, if goods that pay taxes are sold continuously, the National Tax Service can impose sanctions, such as tax evasion, tax investigation, and collection of taxes on unregistered businesses. It is also illegal to sell goods because the size and color do not match. In principle, if the size or color does not match, it is necessary to return it to the seller. If the consumer sells them back in Korea, they will be investigated by customs for smuggling under the Customs Law. It is important to note that selling one of the items after purchasing multiple items is also subject to suspicion of smuggling or Tax Evasion under the Customs Law.

According to the Customs Law, smuggling charges are punishable by imprisonment with work for up to five years or a fine of up to 10 times the amount of customs duties, and a fine of up to the highest cost of goods. Customs evasion charges are punishable by imprisonment with work for less than three years, five times the amount of tax evasion, and fines equivalent to less than the highest cost of goods. In particular, if illegal activities are caught several times, prosecutors are more likely to report them to authorities.

The customs law does not punish people who sell goods that they already used. In the case of electronic devices, such as the iPhone and MacBook purchased directly from overseas, the current law has blocked them, even though there is a lot of demand for second-hand transactions. Recently, however, the government has decided to allow individuals to trade electronic devices that have been imported for more than a year. An official from the Ministry of Science, Technology and Information and Communication said, "We have decided to revise the law in line with the popularization of shopping on overseas websites. Considering that the average life expectancy of information and communication technology products is about two to three years, we believe that the purpose of personal use at the time of importation has been achieved." However, if goods are distributed in Korea without certification or do not meet requirements for their own use, they will be punished by relevant agencies. In order to sell goods purchased directly from overseas, customs duties and VAT charges must be paid through formal import declaration procedures. If customs clearance is carried out for the purpose of personal use through International Speed Mail or an inventory clearance, formal import declaration must be made through re-entry procedures.

In principle, if you don't like the product you bought overseas, you should return it to the place where you bought it. Even if you post a message that sells goods directly overseas, if you delete it yourself and stop selling the goods directly overseas, the probability of being investigated or punished will be greatly reduced, unless there is a special reason to prosecute. As a consumer, it's up to you where you buy things. If you buy and trade in secondhand goods without breaking the law, you can buy various items cheaply, and consume them reasonably.

By An So-yeon, cub-reporter 1102soy@naver.com

<저작권자 © The Campus Journal, 무단 전재 및 재배포 금지>

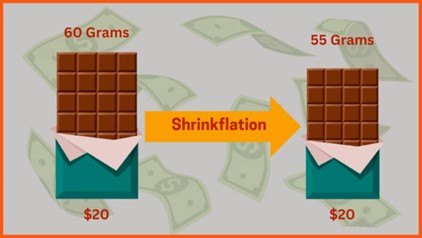

Shrinkflation, Consumer Deception

Shrinkflation, Consumer Deception