The Necessity of National Pension Reform

Anyone with income may have experienced a difference in an actual income received from their monthly salaries due to tax deductions and the four major insurance policies. One of the four major insurance policies is the National Pension Service. As the proportion of the elderly population increases around the world, public interest in national pensions and basic pensions in place to guarantee old age income security is increasing.

The National Pension Service is a government-run public pension system. It is based on the premiums paid by individual citizens while making income, and allows people to maintain their basic quality of life by receiving pensions from themselves or deceased family members when they can no longer bring in income due to age, death, or disability due to sudden accidents or diseases. Korean citizens between 18 and 60 years old are required to contribute to the national pension, except in a few special cases. Even if citizens do not have an income, like students or housewives, they can contribute to their pension although they are not required to.

In South Korea, the burden of future generations and concerns of those who have to prepare for their retirement are increasing significantly due to the rapid aging of the population and low birth rates. According to data released by the Organization for Economic Cooperation and Development in 2019, the nation's elderly poverty rate is 45.7 percent, four times higher than the 12.8 percent average for all 34 member countries. An aging population and a slowdown in population growth greatly constrains the establishing principle of financial stability and financial burden, which are of major importance in the National Pension System. This social change in demographics has increased the need for discussions about the National Pension System.

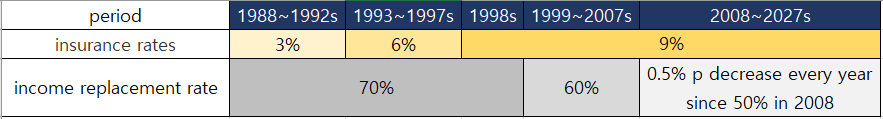

1▲ The flow of insurance premium rate and income replacement rate under the National Pension Act (source of statistic: ESLC). 1▲ The flow of insurance premium rate and income replacement rate under the National Pension Act (source of statistic: ESLC). |

Considering recent changes in population structure and labor market conditions, some say that Korea's pension fund will be depleted by 2057. According to the data released by the National Pension Service, about 3.56 million people are currently receiving the national pension, and the pension amount of the total recipients is an average of 325,130 won per month, which is only half of the minimum living cost (617,281 won) as of this year. The income replacement rate shown in the table above is the ratio that shows how much pension is received later in proportion to the lifetime average income. Last year, the average pension for the elderly pensioners stood at 390,000 won. This is not only less than the 1.03 million won needed for individuals to maintain their minimum quality of life in retirement, but also far less than the 1.45 million won which is needed to maintain a proper life.

In issuing the "Fourth Comprehensive National Pension Plan", the government proposed four measures as policy alternatives to guarantee minimum living costs. The four measures consist of preserving the existing system plan, the Basic Pension Reinforcement Plan, and the Old-Age Income Security Plan 1 and 2. The Basic Pension Reinforcement Plan will raise the basic pension amount by 100,000 won, and pay 40 percent of the income replacement rate along with 400,000 won from basic pension. Measures to strengthen Old-Age Income Security Plan 1 and 2 are to raise the insurance premium rate and income replacement rate by a certain percentage. The revision of the National Pension System should be made through addressing the two goals of fiscal stabilization and enhancing old-age security. These goals may be challenging to achieve because the number of people paying premiums is decreasing due to the low birth rate phenomenon, while the number of people receiving pensions is increasing due to the aging population.

When finding solutions to the problems in the National Pension System, the direction of reform should factor in the political environment of the country and changes in the economic environment. If the government doesn't make an effort to address the problems of the National Pension System then the system will lose credibility as a social security system and social welfare will worsen. For both the current and future generations, the public needs to continue to pay attention and the government needs to actively discuss reforming the system.

By Kim Seong Ju, cub-reporter nicole0215@naver.com

<저작권자 © The Campus Journal, 무단 전재 및 재배포 금지>

Shrinkflation, Consumer Deception

Shrinkflation, Consumer Deception